COVID-19 – Summary of Federal Loan Programs

The download of this summary: COVID-19 – Federal Loan Programs Overview

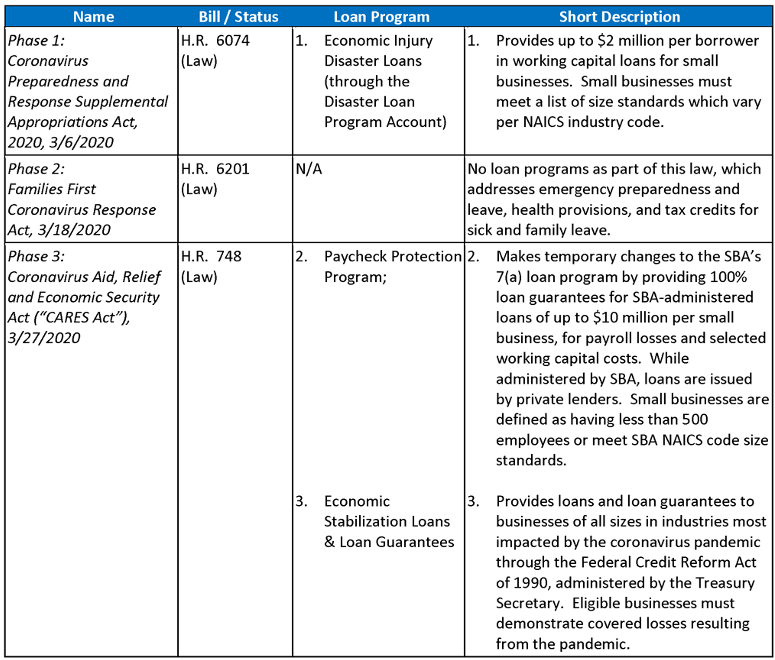

Three phases of a Federal stimulus package to provide relief to those impacted by the Coronavirus pandemic. Phase 1 is comprised of Economic Injury Disaster Loans available under the existing Disaster Loan Program overseen by the U.S. Small Business Administration (“SBA”). Phase 2 does not feature a loan program. Phase 3 is the Coronavirus Aid, Relief and Economic Security Act, HR 748 (“CARES Act”). The CARES Act features both a Paycheck Protection Program and an Economic Stabilization Loan Program geared for larger businesses.

Small Businesses Can Apply for Loans Through the U.S. Small Business Administration’s Economic Injury Disaster Loan Program (EIDL)

The SBA is making available its Economic Injury Disaster Loan Program to qualifying small businesses and nonprofits. The Federal government has announced that it has made $50 billion available for this program, which is available to applicants in those states that have declared disasters to the SBA. As of March 25, 2020, most states and the District of Columbia have been declared statewide as “Disaster Areas,” in which eligible businesses can apply for the loans.

Eligibility

The CARES Act has modified the eligibility requirements for these loans. In order to qualify as a “small business,” a business must:

- Be a business concern having not more than 500 employees;

- Be a sole proprietorship or an independent contractor;

- Be a cooperative with not more than 500 employees;

- Be an ESOP with not more than 500 employees;

- Be a tribal business concern with not more than 500 employees; or

- Qualify under the SBA’s eligibility standards prior to the CARES Act, which require that the applicant comply with SBA size standards that are determined by reference to the applicant’s industry NAICS code. The SBA’s table of codes can be found here: SBA Size Standards. Each industry classification has either a maximum number of employees or a maximum amount of annual receipts (averaged over a three-year period). An applicant must have no greater that the applicable maximum in order to be eligible. Note that employees of certain affiliates of an applicant must be included in calculating eligibility.

How to Apply and Loan Standards

Qualifying small businesses and nonprofits can apply directly to the SBA by following this link: Disaster Loan Assistance. The SBA has stated it will consider the following among its criteria for underwriting these loans:

- An applicant’s credit history;

- An applicant’s ability to repay the loan;

- The applicant’s location in a county declared as a Disaster Area; and

- Whether the applicant’s working capital losses are due to the COVID-19 disaster, as opposed to a downturn in the economy generally or other reasons.

Loan Terms

- Principal, Term and Interest: The SBA can loan an approved applicant up to $2 million, depending on need and underwriting, with a term of up to 30 years for repayment and at interest rates of 3.75% per annum for small businesses and 2.75% per annum for non-profits. Loans in excess of $25,000 may require collateral.

- Personal Guaranties and Collateral: The CARES Act modified EIDL temporarily so personal guaranties will not be required for loans under $200,000. The CARES Act also waived the requirement that an applicant must not be able to obtain credit elsewhere. In a change from its past practice, the SBA has advised it will not decline a loan due to insufficient collateral or lack of collateral. This statement, however, was not embodied in the CARES Act legislation.

- Use of Proceeds: Loan proceeds can be used for working capital, payroll and other expenses that the applicant could have paid had the disaster not occurred. But loan proceeds are not intended to be used to replace lost profits or to finance business expansion.

Advance

The Cares Act provides that during the period from January 31, 2020 through December 31, 2020 the SBA may advance an up to $10,000 grant to each applicant, paid within three days after completing its application to the SBA. The grant is not required to be repaid, even if the applicant does not obtain a loan under the EIDL program, or if the applicant instead obtains a grant under the CARE Act’s Paycheck Protection Program (described below). But if the applicant does instead obtain a grant under the Paycheck Protection Program, the amount of the advance will be reduced from the forgivable amount of such Paycheck Protection Program loan. The advance may be used to pay allowable costs:

- Providing paid sick leave to employees unable to work due to the direct effect of the COVID–19

- Maintaining payroll to retain employees during business disruptions or substantial slowdowns

- Meeting increased costs to obtain materials unavailable from the applicant’s original source due to interrupted supply chains

- Making rent or mortgage payments

- Repaying obligations that cannot be met due to revenue losses.

For more information on requirements for qualification for an Economic Injury Disaster Loan, and the SBA’s programs relating to COVID-19 generally: SBA Coronavirus Resources. A checklist of items to be provided with the application and a description of the procedures for applying for a loan follow.

Checklist of items to be provided with the application:

- Completed Form 5 application form.

- Completed IRS Form 4506-T, including information for:

-

- Each owner with 20% or more ownership interest

- Each general partner or managing member, regardless of ownership %

- Each owner who owns more than 50% of an affiliate business

- At least 2 years complete business tax returns with all schedules

- Most recent year-end balance sheet and income statement

- Current YTD balance sheet and income statement as of most recent month-end

- Schedule of fixed debts

- Personal financial statement on each owner with 20% or more ownership interest

Process:

- Applicants should register for log-in credentials and complete the application on the SBA website.

- The checklist above will be verified and credit will be checked by SBA.

- Forecasts will be completed to determine loan amount.

- Decision can take up to four weeks.

- After approval and loan signing, the first $25,000 is disbursed within five business days.

- Each business or non-profit will work with an assigned case officer on additional disbursements.

- Loan disbursements can repay bank bridge loans up to $25,000.

Paycheck Protection Program

To provide emergency assistance and health care response for individuals, families, and businesses affected by the 2020 coronavirus pandemic.

Summary

- Makes temporary changes to the SBA 7(a) Program, providing for $349 billion in 7(a) loans.

- Part of “Phase 3” of Congress’s effort to address the Coronavirus pandemic.

- Allows for up to $10 million in Small Business Interruption loans to “Impacted Borrowers” with up to $1 million in “Express Loans.”

- Allows proceeds to be used for working capital needs including payroll, rents, utilities and debt obligations.

- Borrower must have less than 500 employees to qualify as a Small Business.

- SBA must provide lender guidance no later than 30 days after the CARES Act becomes law.

Detailed Analysis

Loan Origination Period

The CARES Act specifies that loans may be received by eligible borrower during the period beginning February 15, 2020 and ending December 31, 2020.

Eligibility

Key borrower eligibility requirements include:

- Applicants must make good faith “Certification” that:

- The uncertainty of current economic conditions makes necessary the loan request to support the ongoing operations of the eligible recipient.

- Funds will be used to retain workers and maintain payroll or make mortgage payments, lease payments and utility payments.

- The eligible recipient does not have an application pending nor has received loans for Disaster Recovery Loans or Economic Stabilization Loans under the COVID-19 stimulus package.

- Applicants must be in operation on February 15, 2020.

- Applicant must have employees for whom the borrower paid salaries and payroll taxes or paid independent contractors as reported on IRS Form 1099.

- Any small business concern, private nonprofit organization, or public nonprofit organization may apply, as long as it employs not more than the greater of:

- 500 employees or

- the number of employees permitted for its industry under the SBAs Size Standard guidelines.

- Applicants in industries with an NAICS code beginning with 72 (hospitality/restaurant industries) use a different size standard. Such applicants may apply as long as they have less than 500 employees per location.

- The SBA’s affiliation rules continue to apply, requiring that an applicant’s employees are aggregated with its affiliates for purposes of meeting the 500 employee limit. But the CARES Act specifically waives the affiliation rules for businesses:

- with an NAICS code beginning in 72 (hospitality/restaurants);

- that are franchises assigned a franchise identifier code by the SBA; or

- that receive financial assistance from an SBIC (Small Business Investment Company).

- Eligibility has been extended to include sole proprietors, independent contractors and eligible self-employed individuals.

- A nonprofit entity eligible for payment for items or services furnished under a State plan under title XIX of the Social Security Act or under a waiver of such plan is not eligible.

- An applicant that receives assistance under the Economic Injury Disaster Loan Programs for purposes of paying payroll and providing payroll support is not eligible.

- Principal: Loans are based on “payroll costs” which are defined as the sum of payments of any compensation that is: a) salary, wage, commission or similar compensation, b) payment of cash tip or equivalent, c) payment for vacation, parental, family, medical or sick leave, d) allowance for dismissal or separation, e) payment required for the provisions of group healthcare benefits, including insurance premiums, f) payment of any retirement benefit, g) payment of state or local tax assessed on the compensation of employees, h) sum of payments of any compensation to or income of a sole proprietor or independent contractor that is a wage, commission, income, net earnings from self-employment, or similar compensation not to exceed more than $100,000 in year 1, as pro-rated for the cover period.

The following items will be excluded from payroll costs for the purposes of loan value calculation: a) compensation of an individual employee in excess of an annual salary of $100,000, b) taxes imposed or withheld by chapters 21, 22, or 24 of the Internal Revenue Code, c) compensation of employee whose principal place of residence is outside of the United States, d) qualified sick leave wages for which a credit is allowed under the Families First Coronavirus Response Act, or e) qualified family leave wages for which a credit is allowed under the Families First Coronavirus Response Act.

Each loan will be issued in an amount equal to the lesser of: (A) $10 million, or (B) the average total monthly payments by the applicant for payroll costs during the one-year period before the date on which the loan is made, multiplied by 2.5.

In the case of a seasonal employer, a quarterly calculation is annualized by taking the average total monthly payments for payroll costs for the period beginning February 15, 2019 and ending June 30, 2019 multiplied by 2.5.

Further, up to $1 million is available through the existing SBA express loan process, an increase from the previous maximum of $350,000. SBA express loans feature a 36-hour turnaround time.

- Interest Rates: A covered loan will bear interest at a rate not to exceed 4 percent.

- Length of Term: A covered loan will have a term not exceeding 10 years.

- No Loan Guarantees, Collateral or Credit Elsewhere Requirements: Applicants will not be required to provide personal guaranties or collateral; the Act also waives the Section 7(a) requirement that the applicant not be able to obtain credit elsewhere. The Act makes a temporary change to allow SBA to guarantee 100% of the loan, as opposed to the prior 7(a) guarantee limits of 75%-85%.

- Deferral of Payments : The lender must defer all payments of principal, interest and fees are deferred for at least 6 months and up to one year.

- Use of Proceeds: Applicants may use loan proceeds to pay the following costs:

-

- Payroll support (including paid sick, medical, family and costs related to continuation of group health care benefits during periods of leave)

- Employee salaries, commissions and other compensation

- Mortgage payments

- Rent (including rent under a lease agreement)

- Utilities

- Interest under debt obligations incurred before February 15, 2020

Application Materials

Applications must include documentation verifying the number of full-time equivalent employees on payroll and pay rates including:

- Payroll costs (including paid sick, medical, vacation family and costs related to continuation of group health care benefits during periods of leave)

- Employee salaries, wage commission or other similar compensation, cash or tip

- Payments of interest on any mortgage obligation, not including prepayment or payment of principal on a mortgage obligation

- Allowance for dismissal or separation

- Payment of any retirement benefit

- Payment of State or local tax assessed on the compensation of employees

- Rent (including rent under a lease agreement)

- Utilities (distribution of electricity, gas, water, transportation, telephone or internet access)

- Evidence of any other debt obligations incurred before the covered period

Applications & Approval Timing

Applications must include documentation verifying the number of full-time equivalent employees on payroll and pay rates including:

- payroll tax filings reported to the Internal Revenue Service;

- State income, payroll, and unemployment insurance filings;

- documentation, including cancelled checks, payment receipts, transcripts of accounts, or other documents verifying payments on covered mortgage obligations, payments on covered lease obligations, and covered utility payments;

- any other documentation the Administrator determines necessary

Not later than 60 days after the date on which a lender receives an application for loan forgiveness under this section from an eligible recipient, the lender shall issue a decision on the application.

Forgiveness

Borrowers are eligible for forgiveness of indebtedness on a covered 7(a) loan in an amount (the “Forgivable Amount”) equal to the following costs incurred during the 8-week period after the origination of the loan: payroll costs, payment of interest on mortgages entered into before February 15, 2020, payment on any rent under leases entered into before February 15, 2020 and payments for utility services that began before February 15, 2020. The total amount forgiven can be up to, but not exceeding, the principal amount of the Loan.

Loan forgiveness may be reduced based on reduction of employees or reduction in employee pay.

Reduction of Forgivable Amount based on reduction of employees: For reduction of employees, to determine the amount actually forgiven, the Forgivable Amount will be multiplied by a fraction, the numerator of which is the number of full-time equivalents employed during the 8-week period after loan origination, and the denominator of which is the number of full-time equivalents employed during one of the following periods chosen by the applicant: (a) the period beginning February 15, 2019 and ending June 30, 2019, and (b) the period beginning January 1, 2020 and ending February 29, 2020. Note that seasonal employers must choose the period described in clause (a).

- Consider this example for a company with average monthly employment of 100 employees: if the potentially Forgivable Amount is $1 million but the borrower’s average monthly employment for the year prior to application is reduced from 100 to 75 during the 8-week period, then only $750,000 is eligible to be forgiven (25% reduction in workforce = a 25% reduction in loan forgiveness). All principal of the loan in excess of $750,000 would have to be repaid by the Borrower.

Reduction of Forgivable Amount based on reduction in pay: With respect to a reduction of employee pay, for each employee making not more than $100,000 in annualized salary or wages who has their pay reduced during the 8-week period after loan origination, the Forgivable Amount will be reduced by the amount the reduction exceeds 25% of the employee’s pay for the quarter most recently completed prior to loan origination. These amounts are in addition to the reduction for reduction of employees.

- Consider this example for the same company as above: If the company retained 25 employees but reduced their pay by 30% as compared to the most recent quarter, then the Forgivable Amount would be reduced by 5% (i.e., 30% – 25%) of each affected employee’s annual salary. If the salary of each of those employees had been $100,000, then the Forgivable Amount would be reduced by $125,000 (25 employees times $100,000 times 5%). When added to the $250,000 reduction noted above for reduction in force, the Forgivable Amount would be reduced by a total of $375,000. All principal of the loan in excess of $625,000 would have to be repaid by the borrower.

Forgiveness Applications

All borrowers seeking forgiveness must file an application with the lender containing the documentation described below. No loan will be forgiven without documentation. A decision on forgiveness must be made within 60 days after the lender receives a completed application. The documentation that must be provided includes:

- verification of full-time equivalents for the relevant periods, including IRS payroll tax filings and state income, payroll and unemployment insurance filings

- cancelled checks, receipts, transcripts of account or other documents verifying rent, mortgage interest and rent payments

- a certification by a representative of the borrower that the information provided is true and correct and the proceeds of the loan were used for permissible uses

- any other documentation that the SBA determines is necessary.

Further Guidance

Not later than 30 days after the date of enactment of the Bill, the SBA shall issue guidance and regulations implementing this section. It is the sense of the Senate that the Administrator should issue guidance to lenders and agents to ensure that the processing and disbursement of covered loans prioritizes small business concerns and entities in:

- underserved markets,

- rural markets,

- owned by veterans and members of the military community,

- small business concerns owned and controlled by socially and economically disadvantaged individuals (as defined in section 8(d)(3)(C)),

- women owned and controlled, and

- businesses in operation for less than 2 years.

Summary of Economic Stabilization Loan & Loan Guarantees

The program exists to provide emergency assistance and health care response for individuals, families, and businesses affected by the 2020 coronavirus pandemic.

Summary

- Provides $29 billion to aviation companies, $17 billion to businesses critical to maintain national security and $454 billion to other negatively impacted businesses through loan, loan guarantees within provisions of the Federal Credit Reform Act of 1990 and other investments in programs and facilities through the Federal Reserve.

- States and Municipalities may receive loans, loan guarantees and investments from the amounts listed above as long as the total amounts awarded through the bill do not exceed $500 billion.

- The CARES Act does not provide a specific allocation distribution of direct loans vs. loan guarantees, nor does it include language on maximum amounts.

- Eligible businesses must have incurred covered losses, direct or incremental, incurred as a result of coronavirus, as determined by the Treasury Secretary.

- Provides limits on wage increases to high-wage employee compensation during a two-year period.

- Specific procedures for application and minimum requirements will be published by the Treasury Secretary within 10 days after enactment of the CARES Act.

Distribution of Loans and Loan Guarantees

The Treasury Secretary authorizes $500 billion in loans and loan guarantees to businesses, states and municipalities of any size through the provisions of the Federal Credit Reform Act of 1990.

- Not more than $25,000,000,000 shall be available for passenger air carriers.

- Not more than $4,000,000,000 shall be available for cargo air carriers.

- Not more than $17,000,000,000 for businesses critical to maintaining national security

- Not more than $454,000,000,000 shall be available for other eligible businesses.

Eligibility

- Must be a state or municipality or an eligible business. An “eligible business” is defined as:

- an air carrier; or

- a United States business that has not otherwise received adequate economic relief in the form of loans or loan guarantees provided under the CARES Act

- Other credit must not be reasonably available at the time of the transaction.

- Intended obligations must be prudently incurred.

- The loan or loan guarantee must be sufficiently secured.

Rates

Any loans made by the Treasury Secretary shall be at a rate not less than a rate taking into consideration the current average yield on outstanding marketable obligations of the United States of comparable maturity.

Terms

The loan or loan guarantee is either (a) sufficiently secured, or (b) is made at a rate that (i) reflects the risk of the loan or loan guarantee, and (ii) is to the extent practicable, not less than an interest rate based on market conditions for comparable obligations prevalent prior to the outbreak of COVID-19.

The duration of loans or loan guarantees should be as short as practicable, and not to exceed 5 years.

Except to the extent required under a contractual obligation in effect as of the date the bill is enacted, the CARES Act prohibits the eligible business from repurchasing any outstanding equity interests while the loan or loan guarantee is outstanding.

The CARES Act provides that, until the date 12 months after the date the loan or loan guarantee is no longer outstanding, the eligible business shall not pay dividends or make other capital distributions with respect to the common stock of the eligible business.

Prohibition on Loan Forgiveness

The principal amount of any obligation issued by an eligible business, state, or municipality that is acquired under a program or facility shall not be reduced through loan forgiveness.

Employee Retention

The loan or loan guarantee through agreement requires eligible businesses to maintain existing employment levels as of March 24, 2020 until September 30, 2020, and shall not reduce its employment by more than 10 percent from the levels on such date.

High-Wage Employee Compensation Limits

If an eligible business receives a loan or loan guarantee, during a 1-year period starting on the date the agreement is executed, no officer or employee of the eligible business whose total compensation exceeded $425,000 in calendar year 2019 will receive from the eligible business:

- total compensation which exceeds, during any 12 consecutive months of such period, the total compensation received by the officer or employee from the eligible business in calendar year 2019; and

- will receive from the eligible business severance pay or other benefits upon termination of employment with the eligible business which exceeds twice the maximum total compensation received by the officer or employee from the eligible business in calendar year 2019.

If an eligible business receives a loan or loan guarantee, during a 1-year period starting on the date the agreement is executed, no officer or employee of the eligible business whose total compensation exceeded $3,000,000 in calendar year 2019 will receive from the eligible business during any 12 consecutive months of such period total compensation in excess of the sum of:

- $3,000,000; and

- 50% of the excess over $3,000,000 of the total compensation received by the officer or employee from the eligible business in calendar year 2019.

The term “total compensation” includes salary, bonuses, awards of stock, and other financial benefits provided by an eligible business to an officer or employee of the eligible business.

General Terms & Conditions

For the avoidance of doubt, any applicable requirements under section 13(3) of the Federal Reserve Act (12 U.S.C. 343(3)), including requirements relating to loan collateralization, taxpayer protection, and borrower solvency, shall apply with respect to any obligation or other interest issued by an eligible business, State, or municipality that is acquired under a program or facility under subsection (b)(4).

Terms, conditions and containment of covenants, representatives, warranties, and requirements (including requirements for audits) will be determined as Treasury Secretary deems appropriate.

Further Guidance & Future Programs for Consideration

No later than 10 days after the date of enactment of the CARES Act, the Treasury Secretary shall publish procedures for application and minimum requirements, which may be supplemented by the Treasury Secretary in the Treasury Secretary’s discretion, for the making of loans and loan guarantees.

Mid-size & Large Business Financing

The Treasury Secretary shall endeavor to create a program or facility that provides financing to banks to make direct loans to eligible businesses between 500 – 10,000 employees with an annualized interest rate not higher than 2% per annum, with no principal or interest during the first 6 months. The loans would be based on good faith certifications that a) uncertainty of economic conditions deem the loan necessary, b) funds will be used to retain 90% of the recipients workforce at full compensation and benefits until September 30, 2020, c) workforce and compensation levels from February 1, 2020 will be restored no later than 4 months after termination of the COVID-19 public health emergency

Main Street Lending Program

Nothing shall limit the Federal Reserve System to establish a Main Street Lending Program or other similar program or facility that supports lending to small and mid-sized businesses on such terms and conditions as the Board may set consistent with section 13(3) of the Federal Reserve Act 16 (12 U.S.C. 343(3)), including any such program in which the Treasury Secretary makes a loan, loan guarantee, or other investment under subsection (b)(4).

Government Participants

The Treasury Secretary shall endeavor to seek the implementation of a program or facility in accordance with subsection (b)(4) that provides liquidity to the financial system that supports lending to states and municipalities.

This publication is intended for general information purposes only and does not and is not intended to constitute legal advice. The reader should consult with legal counsel to determine how laws or decisions discussed herein apply to the reader’s specific circumstances.